The most compelling 2026 trend in customer communications management is its changing relationship to consumer payments.

Leading companies are striving to create what’s essentially a single bill-to-payment experience instead of two distinct customer interactions that occur days or weeks apart. It’s all about shrinking time-to-cash, driven by easier, more satisfying customer experiences.

Early moves in this direction include using CCM solutions to offer Text-to-Pay links and individual QR codes that remove steps between billing and payments. This focus is quickly expanding to more enterprises, as CCM platforms, delivery channel technology, digital credentials and payments, all working in concert and increasingly AI-enabled, are helping merge these pivotal customer touchpoints.

But technology alone won’t be enough to realize this goal. It also requires that companies break down organizational walls that separate customer communications and consumer payments, reworking processes, systems and job responsibilities to spur greater collaboration and seamlessness between the two functions.

CCM software powering payments

Leveraging CCM software, especially when integrated with electronic bill presentment and payment technology, companies can assemble the critical elements necessary for orchestrating condensed billing and payment experiences that are tailored for each customer. Here are four of them:

Digital communication records. A powerful and versatile omnichannel cloud CCM platform takes data and PDFs and turns them into digital communication records. Made up of customer-specific information including name, account number, amount due and due date, DCRs are the building blocks for creating a variety of communication types, including documents, delivered through multiple channels.

The CCM platform and DCRs make it possible to personalize formats, delivery channels, messaging, images, payment information and more. Fitting communications to meet each customer’s definition of choice, convenience and ease of use is key to breaking down barriers so customers open and act on their bills. Printed, email and text communications also can build in payment shortcuts including individual QR codes and links that don’t require customers to go through multiple log on and authentication steps.

Read Shifting Our Thinking from Documents to Digital Communication Records for more information.

Diverse delivery channels. As delivery channels evolve and add more features, companies can make more strategic use of them to connect with and engage their customers. Each major communication channel, including print and mail, email, and text messaging, now offers multiple variations that fit different customer needs and communication purposes. For example, a flexible CCM solution enables such email options as message-only, standard email with a link to a PDF and secure email with a link that requires authentication.

Similarly, traditional short, text-only messages (SMS) and longer, multimedia messaging (MMS) continue to work well for some business communications while the advent of rich communication service (RCS) available on CCM platforms is presenting new opportunities to deliver secure, interactive communications. Built into native phone apps, RCS supports more app-like business interactions with verified branding, high-resolution photos and videos, interactive buttons and content for real-time customer action, and read receipts delivered over carrier networks, cellular data and WiFi.

Read Pick the Right Text Messaging Channels to Connect with Customers and Accelerate Payments to learn more.

Digital credentials. Digital credentials are secure payment shortcuts, ensuring a person’s identity without requiring consumers to input user names and passwords and go through other authentication measures. According to IBM, hackers would have to steal the credential, which is much harder to do than crack a password. And digital credentials are difficult to counterfeit because they often rely on encryption or blockchain for security.

Online payments. Consumers leverage digital credentials for bill pay by using mobile wallets (Apple Pay, Google Pay), online banking apps, or third-party platforms (Venmo) that securely store and use digital versions of their payment information. They enable quick and tokenized payments via such methods as ACH, credit cards, QR codes or one-click payments.

Companies can leverage digital credentials in several ways, including:

- Include digital wallets as options for payment sites.

- Implement verifiable credentials with consumers securely sharing only necessary, verified data from a trusted issuer (such as a bank or government body) to set up accounts and authorize payments.

- Use a CCM solution to send a secure payment link via digital communications or a QR code that leverages the customer’s stored digital credentials for a one-click payment.

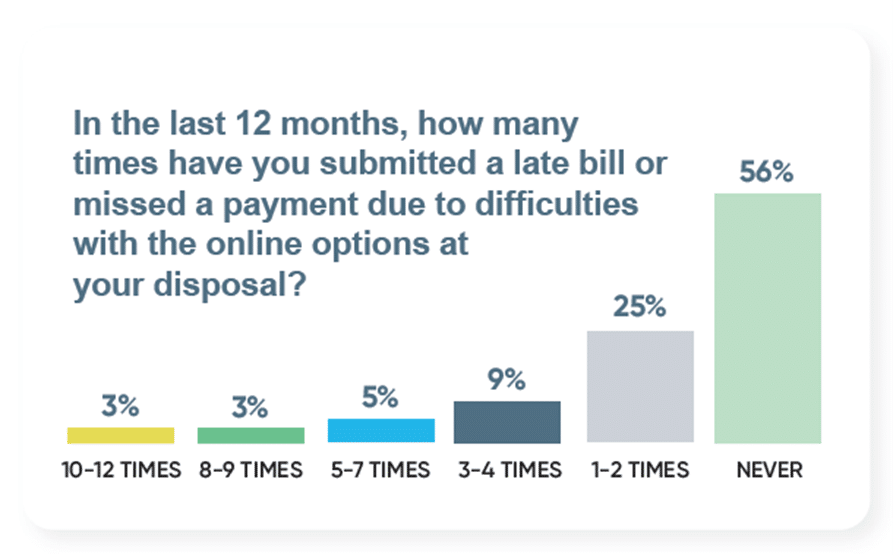

People regularly exit before completing the payment process. A full 72% of consumers have encountered major problems paying their bills digitally, up 12% from the previous year, according to the 2025 State of Online Payments report. The top reason was forgetting their username and/or password but other obstacles included no payment reminder, lack of payment options, and lack of payment confirmation.

Delivering a bill that engages with a one-step click or scan to pay could solve many of these problems. It also would likely decrease late payments and no payments.

Compressed bill-to-pay experiences appeal to both consumers and billers. Companies that set this goal will need to harness the technologies now making them possible as well as rework internal processes to bring billing and payments closer together in their organizations. An omnichannel CCM platform that centralizes customer communications and integrates consumer payments is the critical foundation for success.

Key takeaways:

- The biggest 2026 CCM trend is condensing consumer billing and payments into one experience instead of two separate interactions.

- It takes leveraging cloud omnichannel CCM solutions with digital communication records, evolving delivery channel technologies, digital credentials and payment advances.

- Companies also need to rework internal processes and systems so billing and payments departments work together.

To learn more about creating condensed billing-to-payments experiences, please contact us.