What is EBPP?

Electronic bill presentment and payment (EBPP) is the digital delivery and collection of bills and payments. It replaces or complements traditional paper billing with a faster, more efficient, and user-friendly experience for both businesses and their customers.

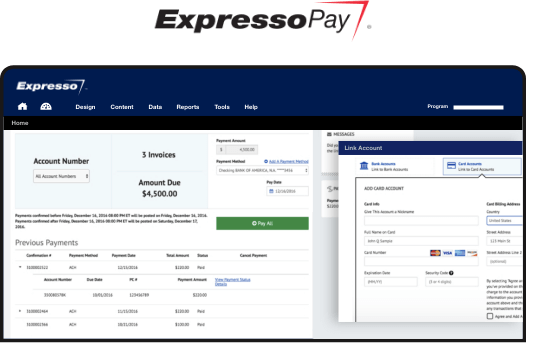

Our ExpressoPay® EBPP solution enables you to:

- Send bills and statements digitally through web, mobile, email, or text

- Accept secure payments via ACH, credit card, debit card, or digital wallets

- Offer flexible options like one-time, recurring, or scheduled payments

- Reduce mailing costs and speed up collections

- Improve the customer experience with 24/7 self-service tools

- Stay secure and compliant with support for HIPAA, SOC 2, SSAE 18, and PCI Level 1

Electronic Bill Presentment and Payment (EBPP) Made Easy

Our EBPP solutions streamline the bill paying process for you and your customers.

With ExpressoPay, you can easily add digital consumer services and accept payments online via mobile or phone.

BENEFITS

EBPP Solutions that Drive Customer Engagement

Improve your bottom line

Our electronic bill presentment and payment (EBPP) solutions helps businesses get paid faster. You can reduce collection cycle time, billing expenses and days outstanding and improve cash flow.

Drive EBPP adoption

Enable customers to switch from paper to digital billing with EBPP, reducing mailing and call-center costs through 24/7 self-service via web, mobile, and IVR.

Improve customer experience

Offer the flexibility and convenience today’s consumers expect. EBPP supports multiple payment options – including ACH, credit/debit cards, PayPal, and Apple Pay – on a secure, branded platform.

Increase productivity and efficiency

Automate your operations, eliminating tedious manual steps with EBPP cloud technology that boosts productivity, improves efficiency and amplifies effectiveness.

Key EBPP Features

Our EBPP solutions offer a full range of tools to help you simplify the entire bill presentment and payment process.

- Secure online statement delivery

- Automated payment reminders

- Self-service bill management

- Branded payment website

- Controlled fund disbursement

- Easy system integration

- Paperless opt-in/out

- Flexible payment options

- Configurable platform

- Simple customer migration and access

- Call center support

- Real-time reporting tools

WHITE PAPER

Integrating Communications and Payments Improves Customer Experience

Discover the power of seamless billing and payments integration in improving the customer experience. Our white paper explores the benefits of electronic bill presentment and payment (EBPP) solutions, revealing how personalized interactions and preferred communication channels drive customer satisfaction, loyalty, and timely payments.

INFOGRAPHIC

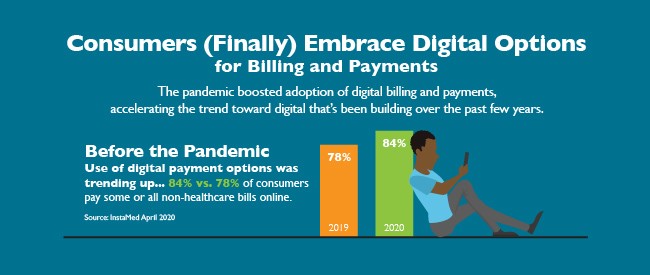

Consumers Want Electronic Bill Presentment and Payment

Consumers from all age groups are making the move to digital bill payments. Check out our infographic for key statistics and survey results that reveal new trends in consumer preferences and behavior when it comes to paying bills.

DISCOVER MORE FROM NORDIS

Electronic Bill Presentment and Payment (EBPP) FAQs

Electronic bill presentment and payment (EBPP) allows consumers to view and pay their bills online, usually on a company portal, using a smartphone, laptop, tablet or desktop computer. According to Datos Insights, 63% of U.S. consumers pay their bills online via a biller, bank or third-party website

The best EBPP solutions create a secure account management and payment experience that is easy and frictionless with online options that allow consumers to:

- View statements and payment history

- Make one-time payments

- Automate recurring payments using stored payment methods

- Set up payment plans

- Choose from a range of payment methods, including ACH, debit/credit card payments, Apple Pay, Amazon Pay, Google Pay and PayPal

Electronic bill presentment and payment solutions improve operating effectiveness and efficiency while improving customer experience.

- Fewer CSR calls: EBPP self-service options reduce the number of calls to customer service centers.

- Lower costs: Reducing paper, printing, and postage associated with paper bills leads to significant cost savings.

- Digital transformation: Replace manual tasks and workflows by automating payment processing and managing exceptions.

- Faster payments: Electronic payments are processed faster than mailed checks, improving cash flow.

- Improved customer satisfaction: Most consumers expect self-service availability and the convenience of digital account management and payment options.

- Enhanced security: Electronic statements are encrypted and transmitted securely, reducing the risk of fraud or identity theft. Many EBPP platforms offer advanced security features such as multi-factor authentication, encryption, and fraud detection algorithms to protect sensitive financial information and prevent unauthorized access or tampering.

Some companies have a fragmented process for consumer bill presentment and payments, with different vendors each handling a delivery channel, such as print/mail, email and text messaging, as well as payment channels including call centers, payment portals and IVR. Working with multiple service providers and systems raises security concerns from sharing confidential personal information with different vendors.

Working with several vendors and systems also makes it more difficult to deliver a consistent customer experience across channels. It’s common for customers to want mailed statements with email or text payment alerts and confirmations and to access the bill on the company’s payment portal.

Alternatively, partnering with a single provider that offers an integrated platform for omnichannel communications and EBPP can increase productivity and efficiency and drive better CX. This integration lets companies streamline and automate much of the process, from developing, managing and distributing billing statements through various digital and print/mail channels to accepting online and mailed payments.

EBPP solutions offer personalized billing features that cater to customer preferences, including one-time payments, automated recurring payments, custom payment plans and payment methods from credit cards to PayPal. When EBPP platforms are integrated with a customer communications management system, companies can further personalize the entire process and customer experience, from bill design to targeted statement messaging and payment reminders.

Giving consumers the ability to manage their accounts online with secure and easy access to view and pay bills anytime from anywhere has a tremendous impact on customer satisfaction and is an environmentally friendly alternative to traditional paper-based billing.

According to ACI Speedpay Pulse, 56% of consumers prefer to receive their billing statements digitally, and 59% use a company’s website to pay their monthly bills.

With EBPP, customers gain a faster, more flexible payment experience.

Yes! Our ExpressoPay® cloud-based EBPP solution streamlines the process of presenting bills and collecting payments. We regularly add features and capabilities, such as managing interactive voice response payments and Text-to-Pay. ExpressoPay enables clients to track key metrics and produce robust reports to gain valuable insights about their customers’ payment habits.

ExpressoPay also seamlessly integrates with our patented Expresso® customer communications management (CCM) software and our print and mail outsourcing services so you can manage all your billing and payments in a single system.

Contact us to learn more or to schedule a demo.