Thanks to the Internal Revenue Service’s 7.1% upward adjustment of 2023 tax brackets due to inflation, more people are likely to receive bigger refunds this spring. The right communications delivered at the right times could persuade consumers to use these once-in-a-year cash infusions to reduce or eliminate their bad debt.

This spring, some filers could see refunds of 10% more than last year, Mark Steber, chief tax information officer for Jackson Hewitt, told CBS News. That’s also a reverse from 2023, when the average refund dropped nearly 3% to $3,167, according to the IRS.

Among consumers expecting a refund, 2 out of 3 say they will save it while the rest plan to pay down debt, according to NerdWallet’s 2024 tax survey. With tax filing season already underway, collectors should seize this moment to develop personalized tax refund communications and offers that put them on more consumers’ short lists for repayment—and even convince some of the savers to redirect their refunds to clearing bad debt.

_______________________________________________

Visit us at Booth #102 at the RMAi 2024 Annual Conference, February 6 – 8

________________________________________________

Too good to refuse

One strategy for convincing consumers to use their refunds for bad debt repayment is making a limited-time settlement offer. Accounts receivable management firm, Professional Credit, has found that clients offering a 20% discount see a threefold increase in revenue.

Working with each client, collectors could develop targeted special offers, especially for medical debt. Consumers usually pay delinquent medical bills last, but combining a discount with a payment plan, for instance, could tip the scales in persuading consumers to apply their tax refunds to these past-due accounts.

Timely and personalized

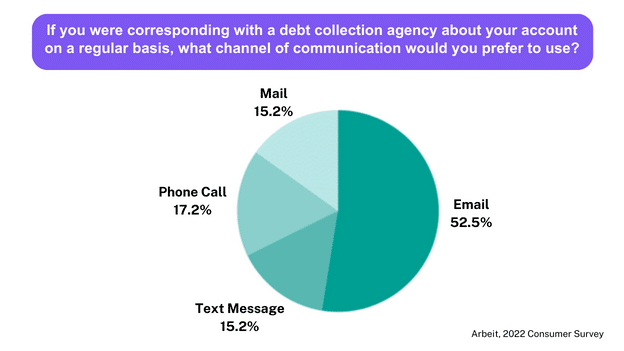

No matter how good the offers, consumers won’t act on them if they don’t receive and read them. Collectors can increase consumer engagement by catering to each person’s preferences for mail, email and text messaging.

Leverage CCM tech to engage

Technology can reduce the complexity of managing all of these consumer preferences and channels. In particular, customer communications management technology lets collectors personalize both the content of each communication and the delivery channel.

CCM platforms give collection firms the control and agility to create timely, compliant communications, such as tax refund campaigns.

Contact us to learn more.