If you haven’t revisited your customer communications programs lately, I want to suggest a new mindset for making the most of them.

For years, most companies thought of customer communications as documents to create and send. But many customers don’t experience them that way anymore, and when I talk with consumers, what I hear is consistent: Make it easy, make it secure, and let me interact on my terms.

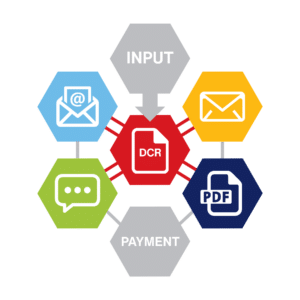

That’s why our customer communications management (CCM) platform Expresso® is in effect taking data and PDFs and turning them into digital communication records (DCRs), which are more flexible and impactful than the rigid concept of a document.

Your goal isn’t to produce a historical record per se, although that’s a byproduct. The goal is to generate engaging customer experiences and immediate action with compliance built in. DCRs enable a better CX, delivering transactional communications in ways customers actually want to receive and interact with them versus how companies have traditionally sent them

DCRs are made of customer-specific data, such as name, address, account number, and amount due. Companies organize and present DCRs in any number of channels and formats, with documents being just one of them. And because communications are created from DCRs in Expresso, you can track, analyze, develop reports and archive them.

Taking a DCR approach, the same transactional communication, such as a monthly auto loan bill, is easily customized to fit different preferred delivery types and methods:

- One customer gets a text message with a secure link to payment portal, where the customer logs in to see the statement and payment options.

- Another receives a secure email that requires authentication before viewing the digital PDF statement in their browser.

- A third receives a printed bill by U.S. mail.

- A fourth customer logs onto their online account and sees the bill presented as a PDF.

Or customers may opt for a more streamlined experience to pay the bill. DCRs can enable 1-click payment experiences, which bypass logins and authentication (stay tuned for ExpressoPay® 1-click payments in 2026!).

Transforming omnichannel communications

Shifting your strategy from documents to DCRs opens up real opportunities to strengthen customer connection.

DCRs can transform each point of contact from a passive experience to an engaging interaction. Engagement takes omnichannel communications that are easier, more personalized, and more consistent. DCRs are the way to enhance CX while also improving company productivity and efficiency. Here’s how:

Dynamic. Instead of a static message, DCRs allow companies to add interactive, personalized content that enables immediate action, be it QR codes on a paper bill or clickable digital link. With Expresso, companies also can gather feedback on each communication and how the customer interacts—or doesn’t—with it. This information loop can help finetune how a company communicates with each customer or customer segment.

Orchestration. From an operational standpoint, DCRs in a single omnichannel CCM platform mean no more manually stitching together each customer’s set of communication preferences from different systems and vendors. DCRs make it easy to coordinate and cater to each customer, simplifying, streamlining and automating:

- Email—secure, standard and message-only

- Text messages: SMS, MMS and RCS

- Print and mail, including automated Certified Mail.

With the omnichannel communication platform in place, DCRs enable companies to significantly improve CX and effectiveness by orchestrating and automating the sequencing of communications to deliver the best experience for each customer. Companies can sequence by drawing on customers’ actions and non-actions, stated and used preferences, formal consents and other triggers such as time frames. For instance, a company can automate printing and sending a hard copy of a bill if a customer does not open an emailed statement or click the payment link in a text message within x days.

Payments. DCRs give companies the ability to create an easy single communications-to-payments experience rather than making them two separate interactions with time in-between. Instead of receiving a mailed or emailed statement, setting it aside for two weeks until getting a payment reminder, then writing a check for payment and putting it in the mail, customers could immediately use the link or QR code in a bill to make a payment.

A fully integrated electronic bill presentment and payments (EBPP) system and more sophisticated and secure QR codes and links that don’t require user names and passwords remove steps so customers are more likely to complete the payment in the moment than drop off during the process.

Amplifying with AI

AI is only going to amplify the impact. With DCRs and AI, companies will be able to provide singular customer communication experiences at scale, also known as hyper-personalization.

One example is next best experiences. In this case, AI takes orchestration and sequencing to a new level by collecting and analyzing customer data in real time. It then determines the best channel at the optimal time based on known customer preferences, consents and account history to follow up to prompt action. It could be a personalized offer, service, informational content or message, such as a payment reminder. And AI makes it possible to develop next best experiences for all customers.

DCRs set up companies to take advantage of new technologies such as AI and new channels, including text messaging’s rich communication services (RCS). They give companies so much more flexibility to create and deliver communications that engage customers, speed up payments and build relationships and loyalty.