What’s keeping auto lenders up at night?

It’s not fear of ride-sharing, once thought to be the biggest potential disruptor of future auto sales. Ninety percent of consumers surveyed, including the majority of millennials, said they still want to own a car, according to the National Automobile Dealers Association.

The real fear is the impact of the digital lifestyle on the auto finance industry, according to the opening session poll at the American Financial Services Association (AFSA) annual Vehicle Finance Conference held in San Francisco in late January. The conference attracted 630 attendees and more than 60 exhibitors in what is now the largest and longest-running convention for the vehicle finance industry.

Due to the rise of mobile, it’s never been easier to research vehicle prices and financing options and even buy a vehicle online, putting dealer and brand loyalty more at risk. Margins for lenders are getting tighter, too, due to the resulting increase in lending competition.

Making the impact of the digital disruption worse, auto dealers and lenders need to contend with an expected slowdown in auto sales in 2019. New vehicle sales rose slightly in 2018 to 17.27 million vehicles, the fourth straight year of more than 17 million-unit sales nationwide. But the auto finance industry is predicting sales of about 16.8 million units this year.

Omnichannel interactions are key

Conference panelists acknowledged that the auto finance industry has been slow, compared to other lending areas, to embrace the digital lifestyle. Among the necessary changes is satisfying customers’ digital preferences for how they receive financial communications, pay their bills and other interactions.

Vehicle buyers want to be able to choose among online and mobile, text, automated phone systems, call center or mailed options. By offering customers choice, lenders and dealers automatically improve the customer experience. This approach also increases engagement, with convenient electronic reminders and ways to view and pay bills so consumers make their payments on time and avoid delinquencies.

Innovative tools make it easy

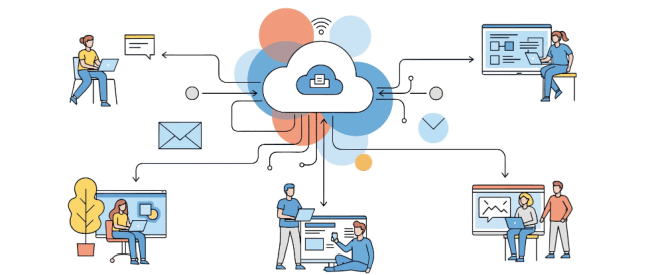

Cloud-based software for managing communications and payments gives auto finance lenders control and flexibility to cater to their customers’ digital lifestyles. Customer communications management (CCM) technology enables companies to create and distribute billing statements, payments confirmations and other customer correspondence via mail, email and text, based on customer preferences. Electronic bill presentment and payments (EBPP) systems securely enable digital account management and accept a range of payment methods such as ACH, credit/debit cards, PayPal, or AmazonPay.

Mobile wallets offer even more communications and payment options. We’ve introduced ExpressoWallet, which allows companies to upload digital statements into Apple Wallet and Google Wallet, both of which are apps already installed on smartphones. Loan balance and payoff amounts can be presented in real-time, with convenient customer connection links and push notifications that alert borrowers that their payment is due or has been received.

The technology to tackle the digital lifestyle is already available. By embracing it, vehicle finance lenders and dealers will stay in the driver’s seat.

About the Author

Bryan joined Nordis Technologies in 2016 to manage and grow the company’s already-large vacation ownership client base. He also is responsible for business development and market expansion in the healthcare and financial services markets. Before joining Nordis, Bryan spent more than 21 years with Interval International, a leading global provider of vacation ownership services. Bryan graduated from Northwestern University with a bachelor of science in political science.

Bryan Ten Broek

Vice President – Business Development